What is Super Deduction?

A new 130% first-year capital allowance for qualifying plant and machinery assets; and a 50% first-year allowance for qualifying special rate assets.

From 1 April 2021 until 31 March 2023, companies investing in qualifying new plant and machinery assets will be able to claim:

a 130% super-deduction capital allowance on qualifying plant and machinery investments

a 50% first-year allowance for qualifying special rate assets

The super-deduction will allow companies to cut their tax bill by up to 25p for every £1 they invest, ensuring the UK capital allowances regime is amongst the world’s most competitive.

The government has offered unprecedented support for businesses during Covid. Even so, pandemic-related economic shocks and the accompanying uncertainty have chilled business investment. This super-deduction will encourage firms to invest in productivity-enhancing plant and machinery assets that will help them grow and to make those investments now.

Why is the government introducing a super-deduction?

- Since the Covid-19 pandemic, existing low levels of business investment have fallen, with a reduction of 11.6% between Q3 2019 and Q3 2020.

- Much of the UK’s productivity gap with competitors is attributable to our historically low levels of business investment compared to our peers. Weak business investment has played a significant role in the slowdown of productivity growth since 2008.

- Making capital allowances more generous works to stimulate business investment. As a result, these measures can promote economic growth and counter business cycles.

- The super-deduction will give companies a strong incentive to make additional investments and to bring planned investments forward.

- A tax information and impact note for the policy, and draft legislation, is published here

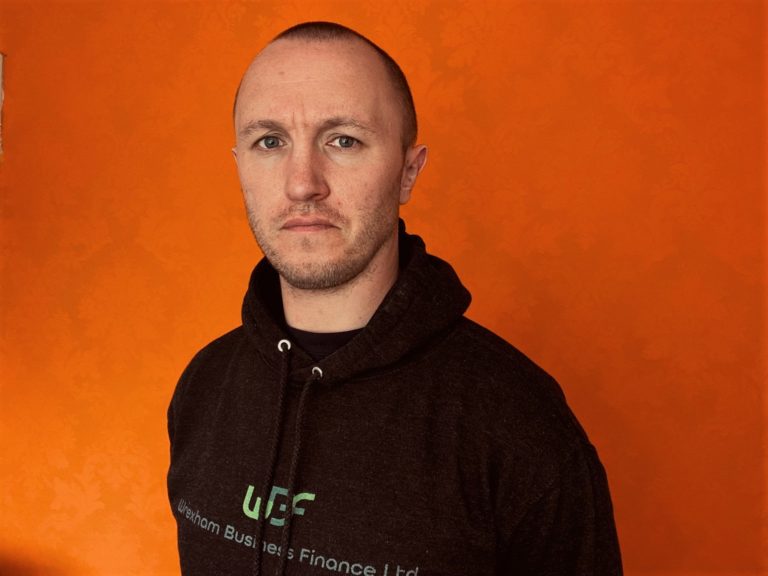

How can we help?

With access to over 80 funders covering all areas of the asset finance industry, we are able to find specific finance solutions tailored to your business. Contact one of our Franchisees to find out how we can help you!